nanny tax calculator california

The 2022 tax rate is 11 percent includes disability insurance and paid family leave on the first 145600 in SDI taxable wages paid to an employee each year. Time Tracker and Scheduler Use the tools when and where it is most.

A nanny tax calculator will help you figure out whether the hourly rate youre offering your nanny will net out to a comfortable take-home wage.

. Overview of California Taxes. GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Yes you must register report employee wages and withhold SDI on the entire 1050.

The Nanny Tax Calculator. Your average tax rate is 1198 and your marginal. California Income Tax Calculator 2021 If you make 70000 a year living in the region of California USA you will be taxed 15111.

For specific tax advice and guidance please call us toll free at 877-626-6924 and a NannyChex payroll and tax expert will. How often is it paid. For example if your nanny grosses 800week then your FICA tax for that pay.

However you are not required to pay UI and ETT because the cash wage limit of 1000 in a quarter has. Nanny Tax Calculator - Nanny Pay Calculator - The Nanny Tax Company Nanny Tax Hourly Calculator Enter your employees information and click on the Calculate button at the bottom. Nanny tax and payroll calculator BUDGET ONLY PAYCHECK AND BUDGET Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks.

Nanny Tax Calculator Learn the withholdings and steps you need take so as to pay your nanny legally. Nanny Tax Calculator Use GrossNet to estimate your federal and state tax obligations for a household employee. Simply multiply your nannys gross wages by 765 to get your FICA tax responsibility.

This calculator will help you understand the total cost of employing a nanny and how much the nanny will take home. Our new address is 110R South. Nanny tax calculator for a nanny share.

If you make 70000 a year living in the region of. California has the highest top marginal income tax rate in the country. Your average tax rate is 1198 and your marginal.

Its also helpful for you to see what tax savings. Household employees in California are covered by both the FLSA and California IWC Wage Order 15 and are non-exempt hourly employees paid at no less than the minimum wage. Its a high-tax state in general which affects the paychecks Californians earn.

This calculator is intended to provide general payroll estimates only. Use Salary vs Overtime to calculate employee overtime pay. Fill in the salary.

Guide To Household Employment Payroll Taxes Hws

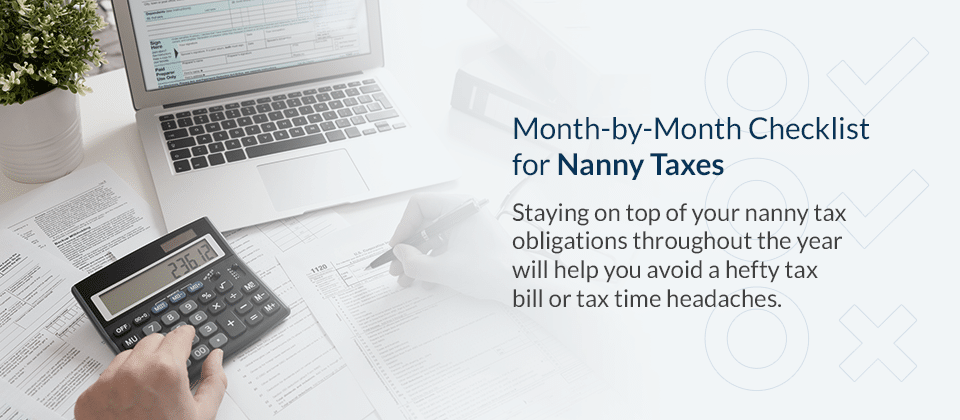

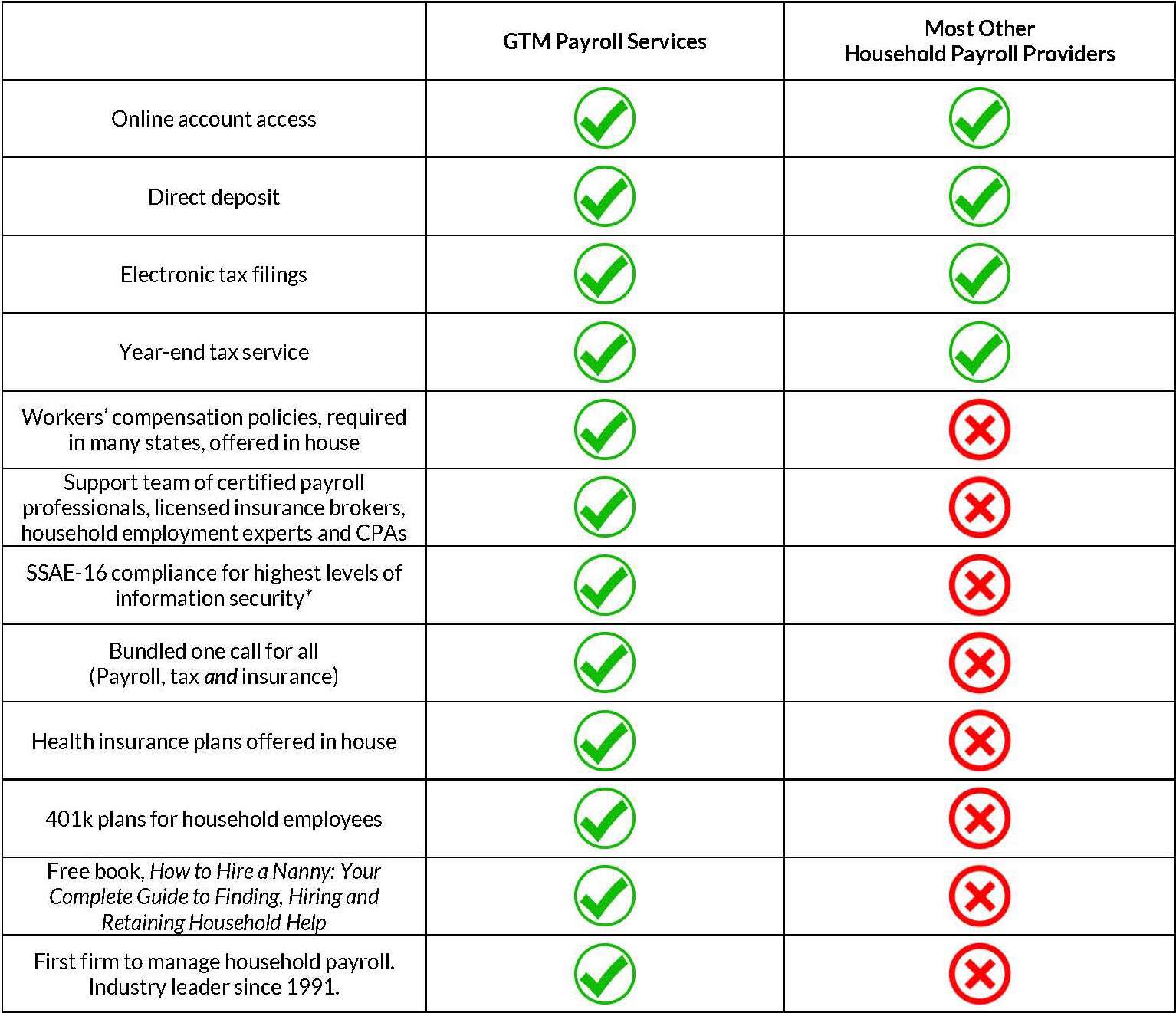

Nanny Payroll Service Comparison Gtm Payroll Services

Guide To Household Employment Payroll Taxes Hws

Nanny Tax Payroll Calculator Gtm Payroll Services

How To Keep Your Nanny Tax Clients Happy

Caregivers Here S How Taxes And Payroll Work Nanny Tax Nanny Nanny Interview Questions

How To Calculate Your Nanny Taxes Aunt Ann S In House Staffing

Payroll Tax Rates 2022 Guide Forbes Advisor

Nanny Tax Threshold For 2021 Sees Slight Increase Of 100

Nanny Tax Payroll Calculator Gtm Payroll Services

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified

Nannypay 1 Diy Payroll Software How To Pay The Nanny Tax

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Payroll Services For Households Adp

Your State S Nanny Tax Requirements Nanny Tax Tools

Nanny Tax Payroll Calculator Gtm Payroll Services

The Diy Household Employee Payroll Service Simple Nanny Payroll